How to calculate cost of borrowing

Labour Expenses for the work of completion of the fixed asset construction. Required Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year ended 31 December 2013.

Pin On Go Math 16 1 Grade 8 Answer Key

When calculating rates keep in mind that IBKR uses a blended rate based on the tiers below.

. When this occurs the cost of borrowing decreases due to normal supply and demand economics. Enter your preferred interest rate. Thus investors and analysts keep a check on the changes in the finance costs of the Companies.

Trademarks Patents are also capitalized because the. Managers will invest only in projects or other assets that will produce returns in excess of the cost of capital. Theyre calculated as a percentage which is applied to the principal amount of your loan.

Cost of debt refers to the effective rate a company pays on its current debt. Central banks attempt to limit inflation. We are an Open Access publisher and international conference Organizer.

To calculate your homes equity divide your current mortgage balance by your homes market value. Explore personal finance topics including credit cards investments identity. Financing costs may be a big cash outflow for some highly leveraged companies.

W5Cost of the Asset at 31122013 250002000015000 6545 66545. If youve made a short list of options from our comparison tables now is the time to enter their details. There are various methods banks use to calculate interest rates and each method will change the amount of interest you pay.

Companies calculate their cost of capital to determine the required return needed to make a capital budgeting investment worthwhile. For example for a balance over USD 1000000 the first 100000 is charged at the Tier I rate the next 900000 at the Tier II rate etc. If you know how to calculate interest rates you will better understand your loan contract with your bank.

Your first step is going to be pulling out your credit card contract and locating the interest and fees your lender charges for a cash advance. Know what the true cost of borrowing money is before you take out a loan and compare products and rates to get the best deal possible. Interest Expenses are also an example of capitalization if the interest is associated with the loan element used to purchase the asset.

Standard debt borrowing from banks Small Business Administration or other current borrowing. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. For example if.

You also will be in a better position to negotiate your interest rate. A lower interest rate. Your monthly interest owed the amount youre borrowing x APR100365 the.

Student loan interest rates represent the cost of borrowing money to pay for school. In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before. Input the principal amount of the loan the period of the loan in months or years and the interest rate of the loan.

A down payment of 20 percent or more or in the case of a refi equity of 20 percent or more gets you off the hook for. This article was originally written on September 17 2020 and updated on June 2. While borrowing more money may lead to a lower WACC a high debt-to-equity ratio can result in.

There is no borrowing limit for PLUS loansthey can be used to pay the full cost of attendance minus any other financial aid received however they have a higher interest rate and origination fee than Stafford Loans as of 2015 the interest rate for. 4 Simple Steps to Calculate the Cost of Money for Your Small Business. The short answer is that your cost of money is the weighted average of your borrowing and deposit interest rates.

As you can see you can use simple interest to figure out roughly how much youll pay for borrowing money. The higher the inflation rate the higher interest rates rise. The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator.

This is where you put loans from founders family members or friends. As compensation for a decline in the purchasing power of money that they will be repaid in the. Learn more about car insurance.

We own and operate 500 peer-reviewed clinical medical life sciences engineering and management journals and hosts 3000 scholarly conferences per year in the fields of clinical medical pharmaceutical life sciences business engineering and technology. In the next section I will explain how to calculate your cost of money in 4 simple steps. The true cost of auto insurance in 2022.

Decreasing Borrowing costs indicate that the company can generate enough cash and income to service its debt and pay timely. Want to calculate how much a cash advance would cost you. Once you find that information plug it into this equation.

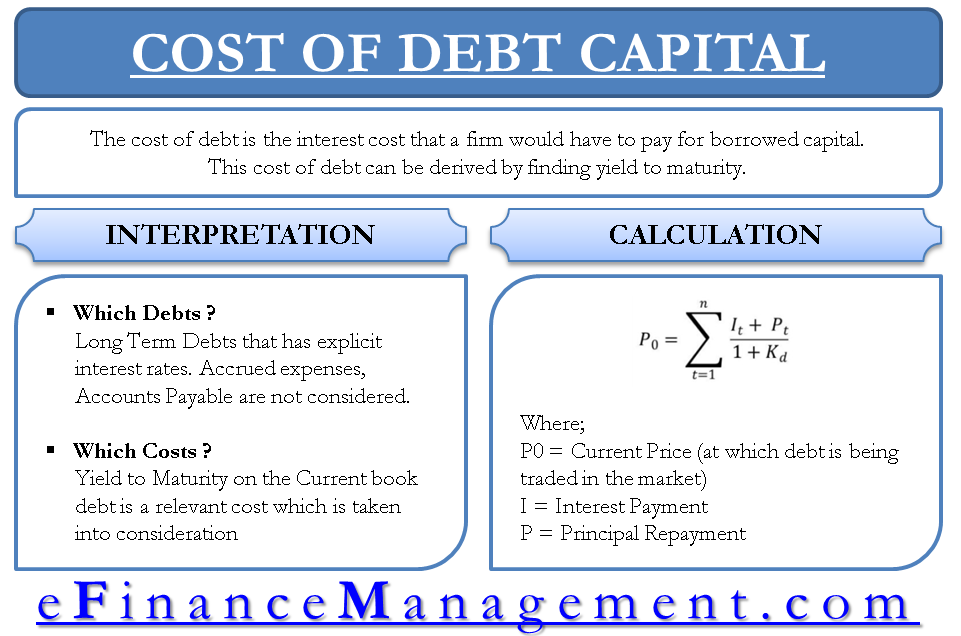

Ensure you request for assistant if you cant find the section. Let us create a spreadsheet with 4 columns. How to Calculate Cost of Debt.

After filling out the order form you fill in the sign up details. In this case the principal balance of 800 becomes 920 over three years. Borrowing less translates to a smaller monthly mortgage payment.

Examples of Capitalization Cost. Material is to be used to construct the asset which is capitalized over the years. Enter how much youd like to borrow.

Inflation is the rate at which the general level of prices for goods and services is rising and consequently the purchasing power of currency is falling. Lets calculate your costs if you have a 20000 loan with a 6 percent APR and a repayment term of 10 years. Additional liabilities that dont have interest charges.

In this case you would take the amount you borrowed and multiply it by your interest. Important Points about Borrowing Costs. Interest Charged on Margin Loans View Examples.

When calculating the cost of replacing tyres include the valve balance and the disposal charge for the old tyre. The calculator will tell you the average monthly payment and calculate the total interest paid over the term of the loan. W4 Weighted Average Borrowing Cost Rate.

In a 4 year period a car could go through a complete set of new tyres. That is because interest earned on money loaned must compensate for inflation. You may have a rough figure in mind based on the car you want to buy but you might like to consider entering different loan amounts to compare repayment estimates.

Chapter 15 Mortgage Calculations And Decisions Ppt Video Online Download

Cost Of Debt Kd Formula And Calculator Excel Template

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Cost Of Debt Kd Formula And Calculator Excel Template

How To Get A Loan From A Bank

Cost Of Debt Kd Formula And Calculator Excel Template

Borrowing Base What It Is How To Calculate It

Difference Between Lease And Finance Economics Lessons Accounting Basics Finance

Journey To Becoming A Chartered Accountant Calculation Of Borrowing Cost

Accounting For Borrowing Costs Overview And Example Accounting Hub

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Understand The Total Cost Of Borrowing Wells Fargo

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Excel Formula Calculate Payment For A Loan Exceljet

Interest Rate Vs Annual Percentage Rate Top 5 Differences Interest Rates Percentage Rate

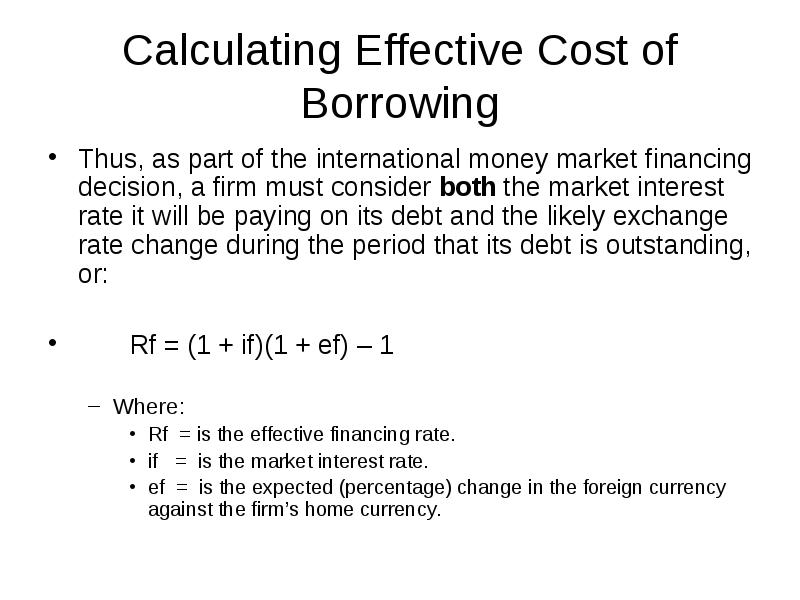

International Finance Chapter 18 Addendum Financing And Investing Short Term

College Cost Calculator The College Board College Costs College Board Cost